Getting a personal loan as a self-employed individual has always been more challenging compared to salaried professionals. Banks rely heavily on stable income, predictable cash flow, and documented earnings — something that self-employed business owners, freelancers, traders, and gig workers often struggle to present. But things have changed drastically in 2025. Digital lending platforms, fintech NBFCs, and several banks have introduced flexible loan options designed specifically for self-employed people.

Whether you run a small shop, freelance online, provide services, or own a growing business, you now have access to a wide range of personal loans with faster approval and less paperwork. This guide will help you understand the best options available, eligibility requirements, interest rates, and how to improve your chances of approval.

Why Personal Loans for Self-Employed Are Different

A salaried employee usually receives a fixed monthly income, which banks consider stable. A self-employed person’s income often fluctuates. This makes traditional banks cautious because they want assurance that the borrower can repay the loan consistently.

However, modern financial lenders have begun using alternate assessment methods like:

- GST filings

- UPI transaction history

- Digital bank statements

- Daily business cash flow

- Platform income (Swiggy, Amazon, Zomato, freelancing portals)

These new assessments make personal loans far more accessible for self-employed borrowers.

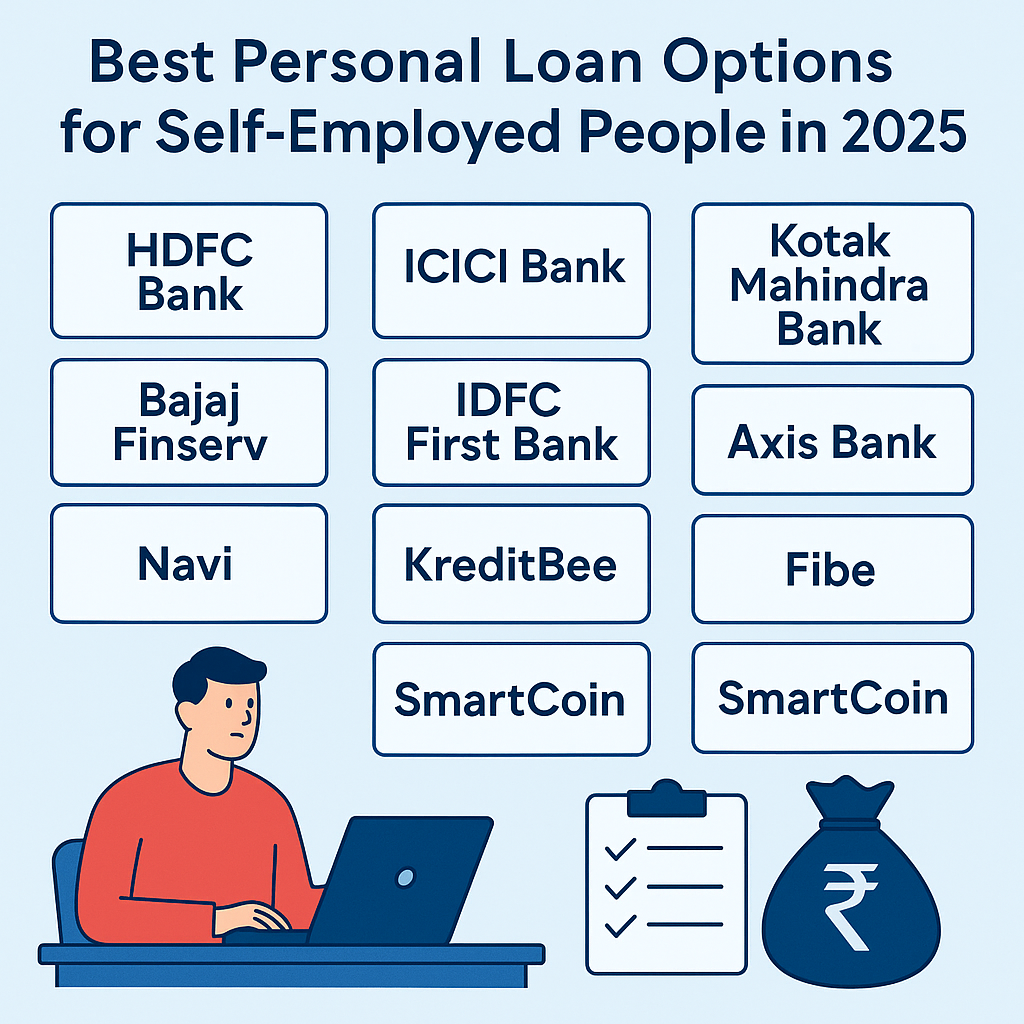

Top Personal Loan Options for Self-Employed People in 2025

Below are the best-performing and most trusted personal loan providers for self-employed individuals this year.

1. HDFC Bank Personal Loan for Self-Employed

HDFC Bank offers one of the most convenient personal loan options for business owners and self-employed individuals. It gives higher approval chances if you maintain a healthy business account.

Key Features:

- Loan amount: ₹50,000 to ₹40,00,000

- Interest rate: Starts from 10.75%

- Tenure: Up to 6 years

- Approval time: 24–48 hours

HDFC considers banking turnover, ITR, and GST to approve the loan.

2. ICICI Bank Quick Personal Loan

ICICI has a dedicated personal loan product for self-employed people with quick processing and comparatively lower documentation.

Key Features:

- Loan amount: ₹50,000 to ₹30,00,000

- Interest rate: 11% onwards

- Flexible EMI structure

- Fast processing with digital verification

They also consider credit card history for approval.

3. Kotak Mahindra Bank Personal Loan

Kotak is known for simple documentation and quick approvals. It is especially good for traders, shop owners, and freelancers.

Key Features:

- Loan amount: ₹25,000 to ₹25,00,000

- Interest rate: From 10.99%

- Tenure: Up to 5 years

- Minimal documentation

Kotak also provides doorstep verification if needed

4. Bajaj Finserv Personal Loan

Bajaj Finserv is one of the best choices for self-employed individuals due to its flexible loan structure and fast approvals.

Key Features:

- Loan amount: ₹30,000 to ₹35,00,000

- Instant approval within minutes

- Interest rate: Starts at 13%

- Very flexible loan tenure up to 84 months

Perfect for business expansion, emergency needs, or managing cash flow.

5. IDFC First Bank Personal Loan

IDFC First Bank is extremely popular among self-employed borrowers because its approval process relies on business banking activity rather than only ITR.

Key Features:

- Loan amount: ₹20,000 to ₹10,00,000

- Interest rate: 10.49% onwards

- Quick approval within a few hours

- Flexible repayment options

Their digital verification system speeds up the entire process.

6. Axis Bank Personal Loan

Axis Bank offers personal loans to self-employed people with strong business banking relations or digital transaction history.

Key Features:

- Loan amount: ₹50,000 to ₹25,00,000

- Tenure: 1 to 5 years

- Interest rate: 10.99% onwards

- Minimal business documents required

A good option for business owners with consistent bank turnover.

7. Navi App Personal Loan

Navi is among the best digital loan providers with extremely fast loan approvals and minimal documents. Ideal for self-employed people who want quick disbursal.

Key Features:

- Loan amount: ₹10,000 to ₹5,00,000

- Interest rate: Starting at 9.9%

- Approval: Under 5 minutes

- No heavy documents required

It uses digital bank statement analysis instead of traditional ITR checks.

8. KreditBee Personal Loan

KreditBee is one of the most accessible options for new and small business owners who lack strong paperwork.

Key Features:

- Loan amount: ₹5,000 to ₹4,00,000

- Approval: 10 minutes

- CIBIL not strictly required

- Monthly income proof necessary

Best for micro-businesses and freelancers.

9. Fibe (EarlySalary) Personal Loan

Fibe is extremely useful for freelancers and online gig workers whose income isn’t fixed but is regular.

Key Features:

- Loan amount: ₹8,000 to ₹5,00,000

- Flexible repayments

- Low document requirement

- Ideal for emergency funds

Their approval is based on bank activity rather than yearly income records.

10. SmartCoin (Best for Micro Business Owners)

SmartCoin is widely used by small shopkeepers, vendors, cab drivers, and freelancers who need quick loans without heavy documents.

Key Features:

- Loan amount: ₹1,000 to ₹1,00,000

- No ITR required

- Simple mobile KYC

- Great for low-income business owners

How Self-Employed Borrowers Can Improve Loan Approval Chances

Follow these practical strategies to get faster and cheaper loan approval:

1. Maintain Clean Banking History

Avoid bounced EMIs, sudden cash drops, or overdrafts.

2. Keep Business Income Stable

Regular incoming transactions boost approval chances.

3. File ITR for Two Years

Even if income is small, filing ITR increases your credibility.

4. Maintain a Good Credit Score

A score above 720 leads to lower interest rates.

5. Use One Consistent Bank Account

Lenders prefer predictable banking activity

Documents Required for Self-Employed Personal Loans

Most lenders ask for:

- Aadhaar card

- PAN card

- Bank statements (6–12 months)

- Business proof (GST, shop certificate, Udyam)

- ITR (optional but helpful)

- Passport-size photo

Some fintech platforms require only Aadhaar + PAN + bank statement.

FAQs

1. Can self-employed people get a personal loan without ITR?

Yes, several fintech lenders like Navi, KreditBee, Fibe, and SmartCoin offer loans without ITR. They use bank statement analysis to understand your income flow. However, for larger loan amounts, traditional banks may still ask for ITR. Filing ITR increases your approval chance.

2. What is the minimum credit score required for self-employed loans?

A credit score above 700 is considered good for self-employed applicants. Some apps approve loans even with lower scores using alternative scoring models. Maintaining clean bank statements helps you get better offers. A higher credit score also reduces interest rates.

3. How fast can self-employed borrowers get a personal loan?

Fintech apps like Navi and KreditBee provide approval within minutes. Banks may take 24–48 hours due to verification steps. If your documents are updated and your bank statement is stable, the process becomes much faster. Quick disbursal is common in 2025.

4. Which loan app is the best for self-employed individuals?

Navi, KreditBee, and Fibe are among the best for quick approval. For higher loan amounts, HDFC, ICICI, and Bajaj Finserv are reliable options. The best choice depends on your income pattern and required loan amount. Always compare interest rates before applying.