Street vendors play a huge role in India’s informal economy, but for decades they had no access to formal banking, credit facilities, or business support. To help these small vendors grow and stabilize their income, the Indian Government launched the PM SVANidhi (Prime Minister Street Vendor’s AtmaNirbhar Nidhi) scheme. This scheme provides easy collateral-free loans so that street vendors can rebuild, expand, or stabilize their small businesses.

In 2025, PM SVANidhi continues to be one of the most impactful micro-credit programs in the country. Whether you sell tea, vegetables, fruits, snacks, clothes, or run a small roadside cart, this loan can help you upgrade your business. If you want to know how to apply, who is eligible, and what documents you need, this guide will explain everything in a clear and easy way.

What Is PM SVANidhi Loan Scheme?

PM SVANidhi is a government-backed micro-loan program for street vendors. The scheme provides small working capital loans in three stages:

- 1st Loan: ₹10,000

- 2nd Loan: ₹20,000

- 3rd Loan: ₹50,000

You can start with the first loan, repay it on time, and become eligible for higher amounts. The loan is collateral-free, meaning you don’t need any security or guarantee.

Key Features of PM SVANidhi Scheme

- No guarantee required

- Very low interest rate (subsidy up to 7%)

- Repayment tenure: 12 months

- Cashback rewards for digital payments

- Higher loan amount on good repayment

- Simple documentation

- Zero penalty for early repayment

This scheme mainly helps vendors restart business after losses or expand daily working capital.

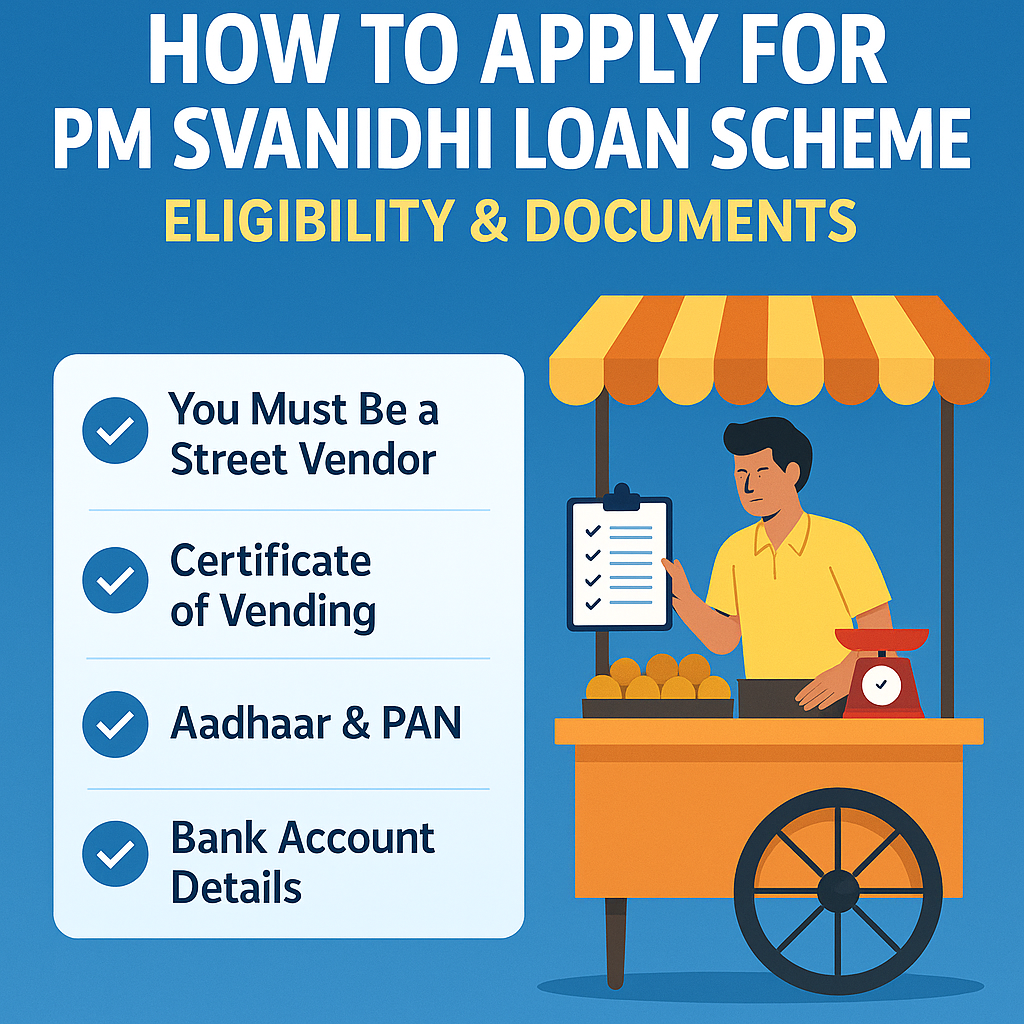

Who Can Apply for PM SVANidhi? (Eligibility)

To qualify, you must meet certain eligibility conditions:

1. You Must Be a Street Vendor

The scheme is designed only for street vendors such as:

- Fruit sellers

- Vegetable vendors

- Tea sellers

- Food carts & snack stalls

- Cloth or mask sellers

- Small roadside shopkeepers

- Cycle cart vendors

- Barbers, cobblers, and small service providers

If your business operates on a small scale on streets or markets, you are eligible.

2. You Must Have a Certificate of Vending

Any one of these works:

- Vendor Certificate from the local municipality

- Letter of Recommendation (LOR) from Town Vending Committee (TVC)

- Provisional Vendor Certificate

If you don’t have these, you can apply for the certificate through your municipality.

3. You Must Have Been Selling Before March 24, 2020

The scheme prioritizes vendors who were working before the lockdown period.

4. Migrant Vendors Are Also Eligible

If you moved from one city to another after the lockdown, you can still apply by showing local verification.

Documents Required for PM SVANidhi Loan

Good news—PM SVANidhi requires very few documents:

Mandatory Documents

- Aadhaar Card

- Mobile Number linked with Aadhaar

- PAN Card

- Bank Account Details (IFSC, account number)

- Vendor Certificate or LOR

Additional Documents (If Requested)

- Passport size photo

- Address proof (Aadhaar is enough)

- Old vendor ID or shop photograph

Most lenders approve with minimal KYC under eKYC mode.

How to Apply for PM SVANidhi Loan (Step-by-Step Guide)

Applying for PM SVANidhi is simple if you follow these easy steps. The application process is fully digital and can be done from a mobile phone.

Step 1: Visit the Official PM SVANidhi Portal

Go to the official website:

pmsvanidhi.mohua.gov.in

Here you’ll find the online application form, guidelines, and vendor support services.

Step 2: Click on “Apply for Loan”

On the homepage, click on:

➡️ Apply for 1st Loan (₹10,000)

If you have already repaid it, choose:

➡️ Apply for 2nd Loan (₹20,000) or

➡️ Apply for 3rd Loan (₹50,000)

Step 3: Complete Your eKYC

You must verify your Aadhaar using:

- Aadhaar OTP

- Biometric (if requested at bank/CSC center)

This connects your identity to your loan application.

Step 4: Upload Required Documents

You need to upload:

- Aadhaar

- PAN

- Vendor Certificate or LOR

All documents can be uploaded as photos from your phone.

Step 5: Choose Your Bank or Lending Institution

You can apply through:

- SBI

- HDFC

- ICICI Bank

- Axis Bank

- Kotak Bank

- Small Finance Banks

- NBFCs

- Cooperative banks

Choose the bank where you already have an account for faster approval.

Step 6: Final Submission

Review your details and submit your application.

You will receive an Application Reference Number (ARN) for tracking.

Step 7: Loan Approval & Disbursal

Most loans get approved within:

- 3–7 working days

Once approved, money is directly transferred to your bank account.

How to Track PM SVANidhi Application

You can track your status using:

➡️ “Track Application Status” option on the portal

Enter your ARN, mobile number, or Aadhaar to check progress.

Benefits of PM SVANidhi Loan Scheme

1. Easy to Apply

No heavy documents or bank visits required.

2. Interest Subsidy

Government provides up to 7% interest subsidy, credited directly to your account.

3. Digital Payment Rewards

If you accept UPI payments (PhonePe, Paytm, Google Pay), you get cashback rewards.

4. Higher Loans on Good Repayment

Repay ₹10,000 → Eligible for ₹20,000

Repay ₹20,000 → Eligible for ₹50,000

5. No Penalty on Early Repayment

You can clear the loan anytime without extra charges.

Common Mistakes to Avoid

- Not uploading clear documents

- Applying with wrong bank account details

- Using a mobile number not linked with Aadhaar

- Missing eKYC verification

- Submitting incorrect vendor certificate

Avoiding these mistakes improves approval speed.

FAQs

1. Who is eligible for the PM SVANidhi loan?

Any street vendor working before 24 March 2020 is eligible. This includes fruit sellers, tea stalls, vegetable carts, and small roadside shops. You must have a vendor certificate or a letter from the municipality. Migrant vendors can also apply with local verification.

2. How much loan can I get under PM SVANidhi?

You can get three loans under the scheme: ₹10,000 (first), ₹20,000 (second), and ₹50,000 (third). Higher loans are available only after repaying the previous one on time. Each loan has a 12-month repayment period. You can repay early without penalty.

3. Is CIBIL score required for PM SVANidhi loan?

No, CIBIL score is not mandatory for this scheme. The loan is approved mainly based on your vendor certificate, KYC details, and bank account. Even people with no credit history can apply. It is one of the easiest government loans to qualify for.

4. How long does it take to get the PM SVANidhi loan?

If your documents are correct and eKYC is completed, approval usually takes 3–7 days. Some banks may take slightly longer depending on verification. Once approved, the loan amount is directly credited to your bank account. Tracking is available on the portal.