When you apply for a loan in India, one of the biggest extra costs you face is the processing fee. Most banks charge anywhere between 1% to 3% of the loan amount as processing fee, which increases your overall cost. For example, on a loan of ₹5,00,000, the processing fee alone can be ₹5,000 to ₹15,000.

This is why many borrowers in India now specifically look for Zero Processing Fee Loans, especially in 2025 when several banks and financial institutions have started offering no-charge loans as promotional offers or under special schemes. If you are planning to take a personal loan, home loan, education loan, or business loan, choosing a bank that offers zero processing fee can save you a significant amount.

In this detailed guide, we will explore what zero-processing-fee loans are, why banks offer them, which banks currently provide them, eligibility, documents required, and the best tips to get approval faster.

What Is a Zero Processing Fee Loan?

A zero processing fee loan simply means you don’t have to pay any extra service charge when applying. Normally, the processing fee covers:

- Application review

- Verification of documents

- Credit score check

- Account validation

- Administrative cost

But under zero-fee loan offers, this charge becomes ₹0.

This reduces the upfront cost of your loan and lowers your financial burden.

Why Do Banks Offer Zero Processing Fee Loans?

Banks and NBFCs offer no-fee loans for several reasons:

- To attract new customers

- To increase loan disbursals during festive seasons

- To compete with digital lending apps

- To promote government-supported schemes

- To encourage borrowers with good profiles

In 2025, digital competition has increased, due to which many banks offer these loans to stay ahead.

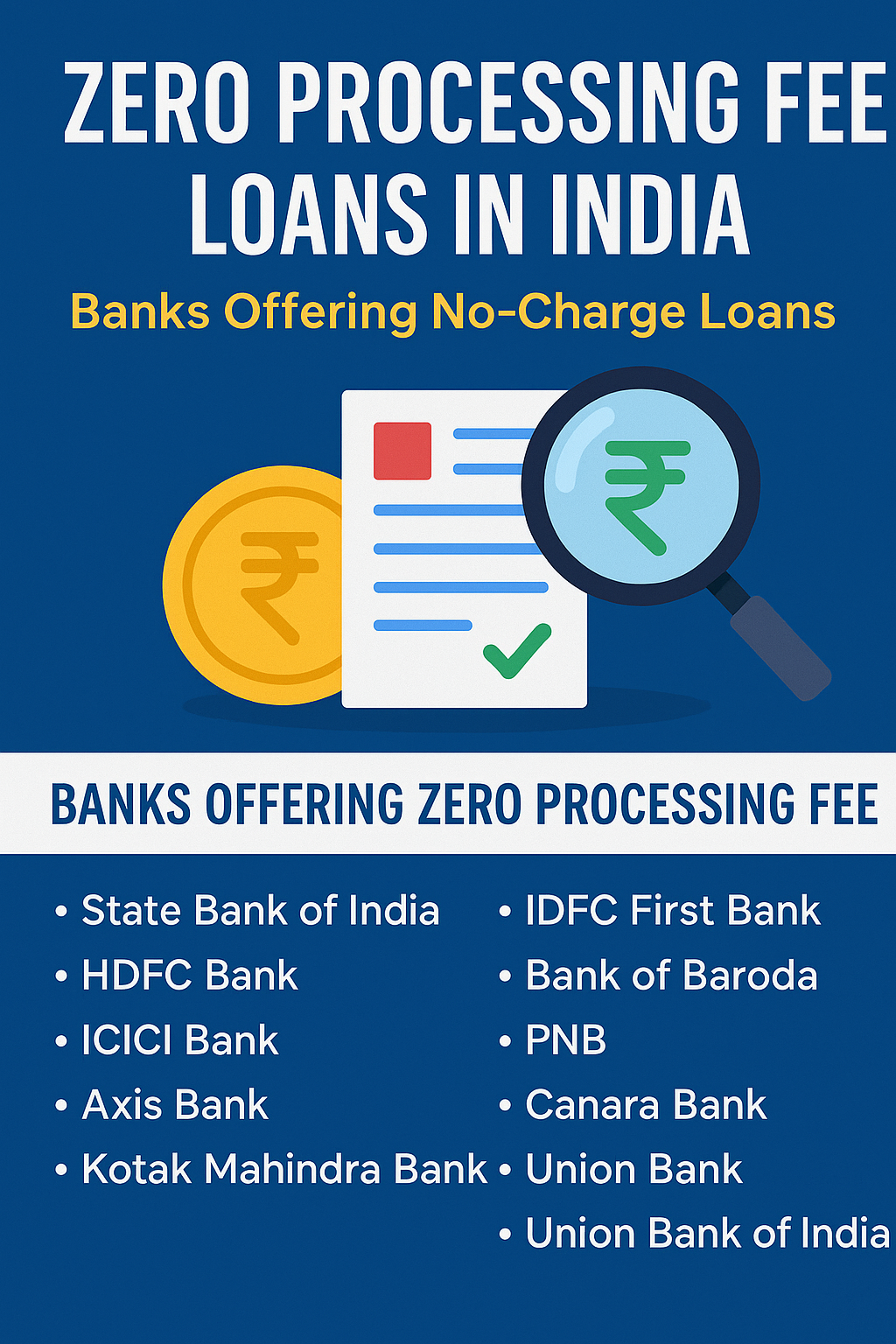

Top Banks Offering Zero Processing Fee Loans in India (2025)

Below are the most trusted and active banks offering no-charge loans in 2025.

1. State Bank of India (SBI)

SBI offers zero processing fee loans on selected categories, especially during festive seasons or special campaigns.

Benefits:

- Zero processing fee on home loans

- Zero fee on pre-approved personal loans

- Affordable interest rates

- High trust and wide availability

SBI is one of the safest choices for no-fee loans.

2. HDFC Bank

HDFC Bank frequently runs limited-time offers where salary account holders get zero processing fee.

Features:

- Zero fee on pre-approved personal loans

- Minimal documentation

- Faster approval

- Attractive interest rates

Employees with HDFC salary accounts often get special benefits.

3. ICICI Bank

ICICI offers zero-fee loans on special loan categories and pre-approved customers.

Best For:

- Pre-approved personal loans

- Festival campaigns

- Select home loans

ICICI is popular for fast disbursal and smooth documentation.

4. Axis Bank

Axis Bank provides zero processing fee options for specific customer groups.

Highlights:

- Zero processing fee for salary account holders

- Instant approval for credit card users

- Zero fee during special promotions

Popular among working professionals.

5. Kotak Mahindra Bank

Kotak frequently offers no-fee personal loans on digital applications.

Features:

- Online-only zero processing fee offers

- Attractive EMIs

- Perfect for people with good credit scores

Kotak’s digital loan division is extremely fast.

6. IDFC First Bank

IDFC First Bank is known for customer-friendly loan features, including no processing fee on multiple loan products.

Benefits:

- Zero processing fee on personal loans

- Lower than usual interest rates

- Instant online approval

Ideal for self-employed & salaried.

7. Bank of Baroda (BoB)

BoB gives zero processing fee on home loans and selected personal loans.

Key Points:

- No processing fee on BoB home loans

- Low interest rates

- High approval chances

Great option for housing and renovation loans.

8. Punjab National Bank (PNB)

PNB sometimes offers zero charges on selected loan categories.

Features:

- Zero processing fee on home loans

- Affordable EMIs

- High trust and government-backed reliability

Recommended for first-time borrowers.

9. Canara Bank

Canara Bank offers zero processing fee for government employees and selected schemes.

Benefits:

- Zero fees for govt salaried

- Lower processing time

- Suitable for medium-size personal loans

Good for government sector employees.

10. Union Bank of India

Union Bank regularly announces no-fee loan promotions.

Highlights:

- Zero processing fee for personal & home loans

- Good interest rates

- Simple documentation

Perfect for borrowers with stable income.

Types of Loans That Commonly Offer Zero Processing Fees

Personal Loans

Home Loans

Car Loans

Education Loans

Business Loans

Pre-Approved Loans

Festival Offer Loans

Pre-approved loans have the highest chance of zero fee because the bank already trusts your profile.

Eligibility Criteria for Zero Processing Fee Loans

Though the processing fee is free, eligibility still matters:

- Minimum age 21–60

- Stable monthly income

- Good banking history

- Credit score above 700 (preferred)

- Clean repayment record

- Valid KYC documents

Some banks offer zero fees only to pre-approved customers.

Documents Required for Zero Processing Fee Loans

Most banks require:

- Aadhaar Card

- PAN Card

- Salary Slip (3 months)

- Bank Statement (6 months)

- Address Proof

- Passport-size photo

Self-employed people need:

- GST certificate

- ITR of last 2 years

- Business account statement

How to Apply for Zero Processing Fee Loans

Step 1: Visit the bank’s website or branch

Step 2: Check if the zero-fee offer is active

Step 3: Complete your eKYC

Step 4: Upload required documents

Step 5: Choose loan amount & tenure

Step 6: Submit the application

Step 7: Get approval & disbursal

Digital applicants often get faster approval.

Tips to Easily Get a Zero-Processing-Fee Loan

- Apply during festival seasons

- Check your pre-approved offers daily

- Maintain a good credit score

- Keep your salary account with the same bank

- Apply through the bank’s mobile app for digital-only offers

Benefits of Zero Processing Fee Loans

- You save upfront costs

- Lower financial burden

- Perfect for emergency needs

- Best for first-time borrowers

- Helps you get higher loan amount

- Makes repayment more affordable

FAQs

1. What is a zero processing fee loan?

It is a loan where the bank does not charge any application or processing fee. This saves you 1–3% of the loan cost. Many banks offer zero-fee loans as promotional deals or for pre-approved customers. This makes borrowing more affordable.

2. Which banks in India offer zero processing fee loans?

Banks like SBI, HDFC, ICICI, Axis Bank, Kotak, IDFC First, BoB, PNB, and Union Bank offer such loans during special offers. These are mostly digital or festive-season promotions. Some banks also offer zero fees to salary account holders. Pre-approved loans often have no charges.

3. Do zero processing fee loans still require documents?

Yes, you still need basic KYC documents such as Aadhaar, PAN, salary slips, and bank statements. The only difference is you don’t pay the fee for application processing. Some digital-only offers need minimal documents. Pre-approved loans usually require no extra paperwork.

4. Can I get zero processing fee personal loans with low credit score?

It’s possible but not very common. Banks still check your credit score before approval. A score above 700 increases your chances. If your score is low, look for pre-approved offers or NBFC promotional schemes. Improving your score helps you get better deals.