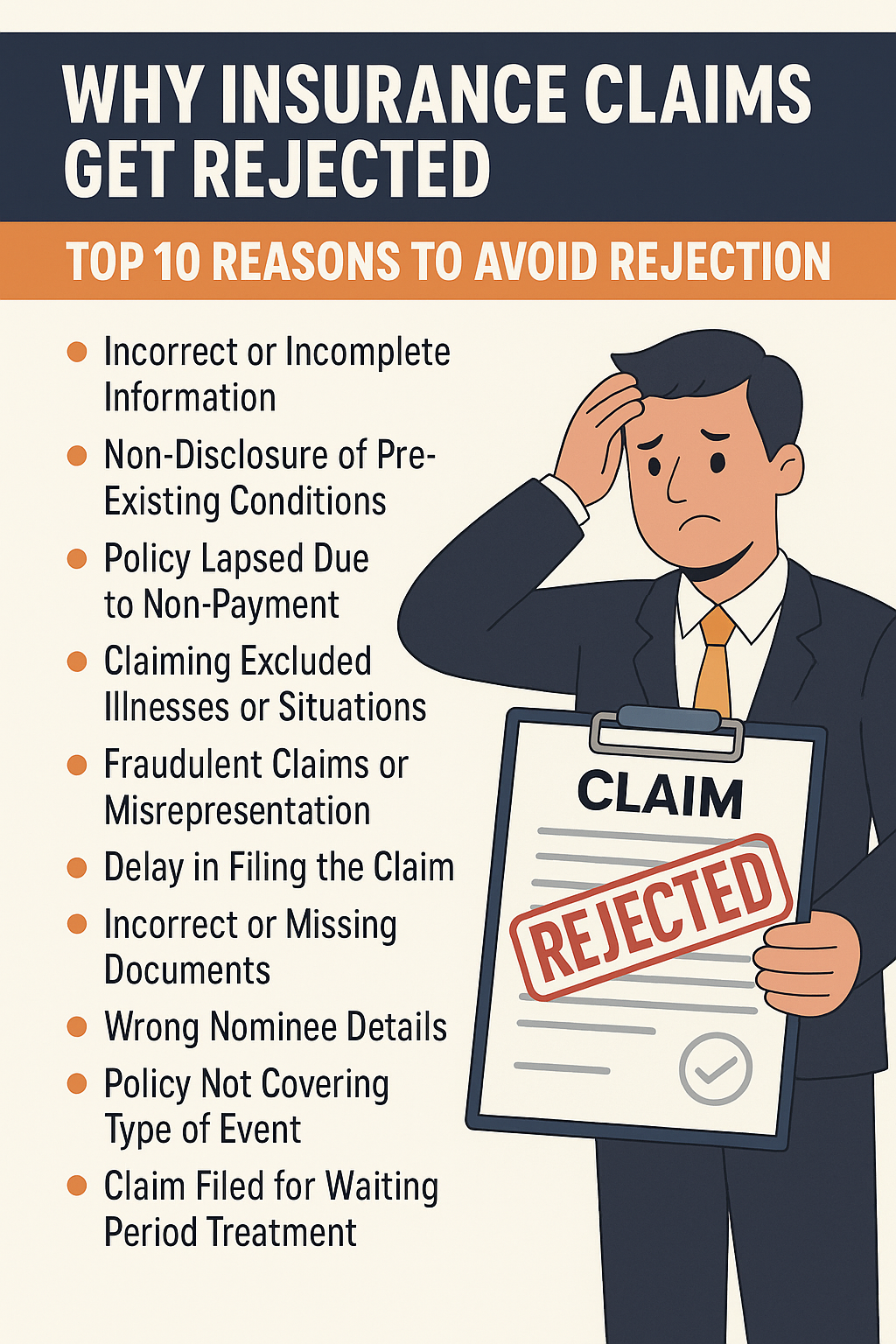

Filing an insurance claim can be stressful, and nothing feels worse than receiving a claim rejection when you need financial support the most. Whether it’s health insurance, life insurance, motor insurance, or travel insurance—claims get rejected every day due to avoidable mistakes. Most people don’t read policy terms carefully or forget to update information, which results in denied claims.

In 2025, insurance companies are relying more on digital verification and strict documentation checks. This means even small errors can lead to delays or rejection. To help you avoid such problems, this guide explains the top 10 common reasons why insurance claims get rejected and how you can prevent them.

1. Incorrect or Incomplete Information

One of the biggest reasons for claim rejection is incorrect details at the time of buying the policy.

Common mistakes:

- Wrong age

- Incorrect health details

- Wrong vehicle information

- Misspelled name

- Incorrect nominee details

Insurance companies verify every detail during claims. A mismatch can lead to direct rejection.

How to avoid this

- Double-check all details before submitting the proposal form

- Update address, contact number, and nominee regularly

- Always use accurate medical and personal information

2. Non-Disclosure of Pre-Existing Conditions

In health and life insurance, hiding health conditions is the biggest reason for rejection.

Examples of non-disclosure:

- Diabetes

- Blood pressure

- Asthma

- Prior surgeries

- Smoking or alcohol habits

Hiding medical history may save you money initially but can lead to complete claim denial later.

How to avoid this

- Be honest about all pre-existing diseases

- Disclose lifestyle habits honestly

- Share all past medical records

3. Policy Lapsed Due to Non-Payment

If your policy expires due to non-payment of premium, your claim will be rejected without consideration.

Why it happens:

- Missed deadlines

- Incorrect auto-debit setup

- Change of bank account

- Ignoring renewal reminders

How to avoid this

- Enable auto-debit

- Set reminders before premium due date

- Keep your email and phone updated

4. Claiming Excluded Illnesses or Situations

Every insurance policy has a list of exclusions—conditions that are not covered.

Common exclusions:

- Cosmetic surgeries

- Infertility treatments

- Self-inflicted injuries

- Pre-existing diseases during waiting period

- Driving without license (motor claims)

- Negligent behavior

Claiming for excluded conditions results in automatic rejection.

How to avoid this

- Read your policy exclusions carefully

- Understand waiting periods

- Follow safety measures and legal requirements

5. Fraudulent Claims or Misrepresentation

Insurance companies check for fraud very strictly.

Fraud examples:

- Faking an accident

- Inflating repair bills

- Wrong hospital receipts

- Misusing someone else’s documents

How to avoid this

- File claims honestly

- Provide only genuine documents

- Never inflate bills for extra claim amount

6. Delay in Filing the Claim

Insurance companies have strict timelines for claim intimation.

Delay happens when:

- Hospitalization without informing insurer

- Motor accidents reported late

- Travel insurance claims filed after trip ends

Late intimation causes suspicion, leading to rejection.

How to avoid this

- Inform insurer within 24 hours for emergencies

- Use app/helpline to notify instantly

- Keep policy number available at all times

7. Incorrect or Missing Documents

Missing documents are one of the most common causes of rejection.

Documents commonly required:

- Hospital bills

- FIR (for accidents/theft)

- Discharge summary

- Police report

- Vehicle repair bills

- Death certificate

- ID proof

If any required document is missing or unclear, your claim may be denied.

How to avoid this

- Keep all bills and reports safe

- Always ask the hospital for a detailed discharge summary

- File FIR immediately in accident/theft cases

8. Wrong Nominee Details

In life insurance, claims often get rejected because nominee details are wrong or outdated.

Reasons:

- Nominee passed away

- Name mismatch

- No nominee added

- Nominee details not updated after marriage/divorce

How to avoid this

- Update nominee details after major life events

- Add backup nominee (contingent nominee)

- Verify spelling and relationship details

9. Policy Not Covering the Type of Event

Sometimes people assume a policy covers everything. But insurance has limitations.

Examples:

- Fire insurance doesn’t cover short-circuit damage

- Travel insurance doesn’t cover adventure sports

- Health insurance may not cover OPD or dental

- Motor insurance without zero dep doesn’t cover parts depreciation

How to avoid this

- Buy add-ons based on needs

- Read policy brochure carefully

- Clarify doubts with insurer before buying

10. Claim Filed for a Waiting Period Treatment

Many health and life insurance policies have waiting periods.

Waiting period examples:

- 30 days initial waiting period

- 2-year waiting for specific diseases (hernia, cataract, etc.)

- 3–4 years waiting for pre-existing diseases

- 90-day waiting for critical illness cover

If you file a claim during the waiting period, it is rejected automatically.

How to avoid this

- Know your waiting periods

- Don’t rely on the policy for newly diagnosed illnesses immediately

- Buy insurance early in life

How to Increase Your Claim Approval Chances (2025 Tips)

✔ Keep your documents ready and clear

✔ Never hide health or personal information

✔ Renew policies on time

✔ Choose insurers with high claim-settlement ratios

✔ Understand exclusions and conditions

✔ Inform the insurer as early as possible

✔ Keep all bills and reports neatly organized

✔ Use insurer’s mobile app for fast claim filing

FAQs

1. Why do insurance companies reject claims?

Claims are rejected due to incomplete information, non-disclosure of diseases, expired policies, missing documents, or claiming uncovered treatments. Most rejections happen due to avoidable mistakes made by policyholders. Reading your policy carefully reduces rejection risk.

2. How can I prevent claim rejection in health insurance?

Always disclose your medical history, understand waiting periods, check exclusions, and keep documents ready. Inform the insurer within the required time and always choose a cashless hospital from the network list. Timely communication is the key to approval.

3. Can my life insurance claim be rejected?

Yes, if details like nominee name, medical history, age, or lifestyle habits were hidden or incorrect. Suicide within the waiting period is also excluded. Updating information and being honest during application ensures smooth claim settlement.

4. What should I do if my claim is rejected?

Request a written explanation for rejection, submit missing documents, and file a claim review. If still unsatisfied, approach the Insurance Ombudsman. Many rejections get approved after appeal if the policyholder provides supporting documents