Studying in India or abroad has become increasingly expensive, and not every student has collateral such as property or fixed assets to pledge for a loan. Recognizing this, banks and NBFCs in India now offer education loans without collateral for deserving students based on their academic profile, course, university, and future earning potential.

In 2025, the number of students opting for unsecured education loans has grown rapidly, especially for higher studies abroad. Whether you’re planning to study engineering, management, medicine, arts, or STEM courses overseas, you can still get a loan without providing any security or guarantor—if you know the right lenders and follow the right process.

This guide explains everything you need to know about collateral-free education loans in India, including eligibility, lenders, documents, and tips to increase your chances of approval.

What Is a Collateral-Free Education Loan?

A collateral-free (unsecured) education loan is a loan given without taking any security, such as:

- House

- Land

- Fixed deposit

- LIC policy

- Property papers

Instead, the bank checks:

- Your academic history

- Course you selected

- University ranking

- Expected salary after graduation

- Co-applicant’s income

- Your financial background

These loans are best for students whose families cannot provide property documents or assets.

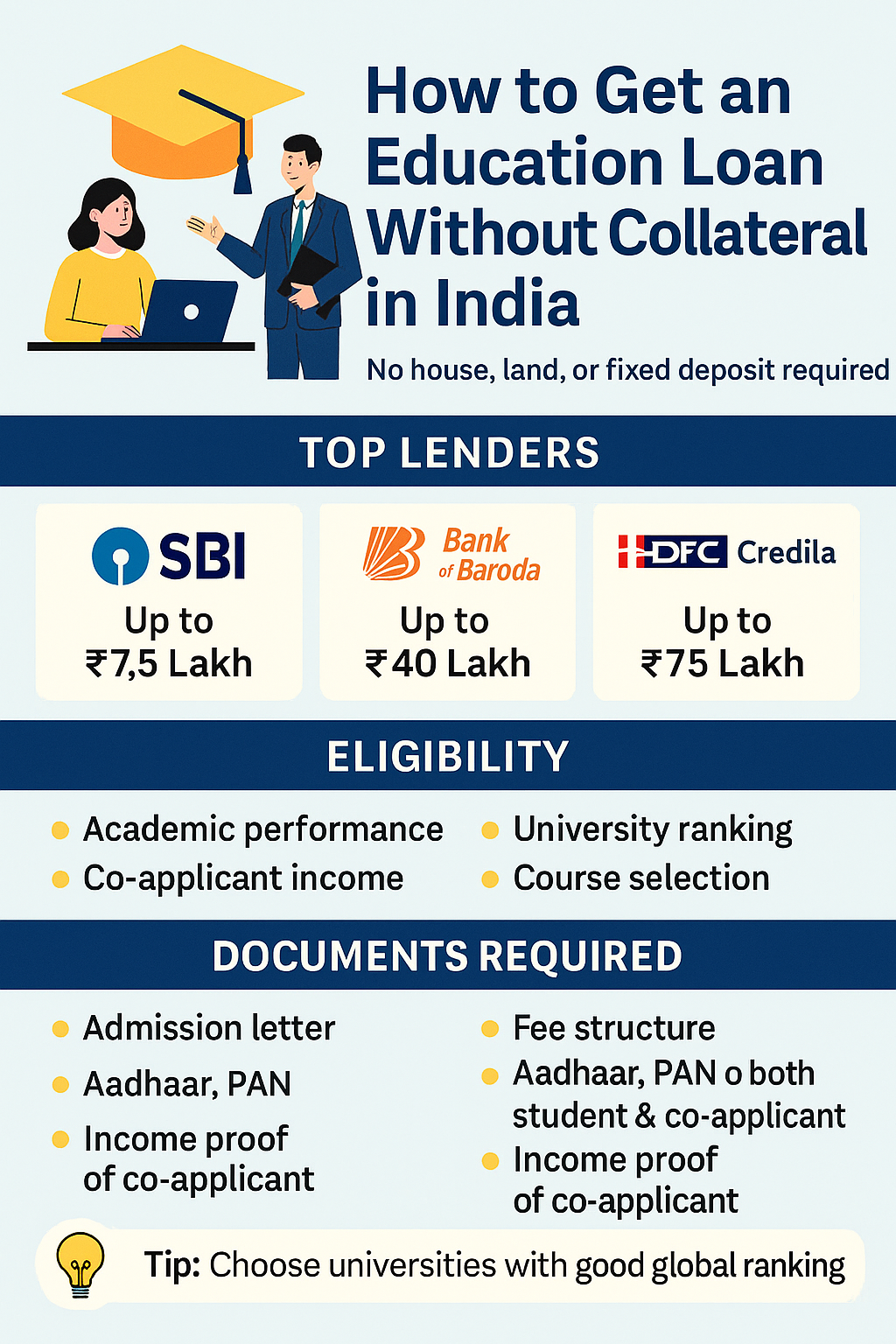

Who Offers Education Loans Without Collateral in India?

There are two types of lenders:

1. Government Banks (Under CGFSEL Scheme)

These include:

- SBI

- Bank of Baroda

- Union Bank

- Punjab National Bank

- Canara Bank

They offer collateral-free education loans up to ₹7.5 lakh under CGFSEL (Credit Guarantee Fund Scheme for Education Loans).

2. Private Banks & NBFCs (High Loan Amount)

These include:

- HDFC Credila

- ICICI Bank

- Axis Bank

- InCred

- Auxilo

- Avanse

- Prodigy Finance (for abroad)

- Leap Finance

They offer collateral-free loans up to ₹60 lakh or even ₹75 lakh, depending on the course and university.

Top Banks Offering Collateral-Free Education Loans

Below is a list of the best lenders with their capabilities:

1. SBI (State Bank of India)

- Up to ₹7.5 lakh collateral-free

- 11% – 12.5% interest rate

- Best for Indian colleges

Good option for undergraduate programs in India.

2. Bank of Baroda (BoB) – Baroda Scholar Loan

- Up to ₹40 lakh unsecured for top foreign universities

- Attractive interest rate

- Widely trusted

Perfect for study-abroad students.

3. Union Bank of India

- ₹7.5 lakh unsecured for Indian programs

- Good for engineering and medical aspirants

Simple processing and quick approval.

Top NBFCs Offering High Collateral-Free Loan Amounts (2025)

NBFCs give the highest unsecured loans but interest rates are slightly higher.

1. HDFC Credila

- Up to ₹75 lakh without security

- Covers full tuition + living expenses

- Ideal for US, UK, Canada, Australia students

One of the most popular loan providers for studying abroad.

2. InCred Finance

- Up to ₹50 lakh unsecured

- No margin money required

- Fast approval

Good for management, STEM, and IT courses.

3. Auxilo

- Up to ₹65 lakh

- Digital processing

- Flexible repayment

Excellent for students with average academic records.

4. Avanse Financial Services

- Up to ₹50–60 lakh

- Covers tuition, living, travel, insurance, laptops

- Smooth online process

Great for students applying to PG courses abroad.

5. Prodigy Finance (Only for Abroad)

- No collateral

- No co-signer

- Based on future earning potential

Very useful for students going to top global universities.

Eligibility Criteria for Collateral-Free Education Loans

Most lenders check:

1. Academic performance

Good grades improve approval chances.

2. University ranking

Top-ranked global universities → lower interest rates + higher loan amount.

3. Co-applicant income

Most lenders need a parent/guardian with stable income.

4. Course selection

STEM, Finance, MBA, IT, and Healthcare programs get better offers.

5. Country of study

USA, Canada, UK, Australia, Germany, Singapore, Ireland have highest approval rates.

Documents Required for Education Loan Without Collateral

Student Documents

- Aadhaar & PAN

- Passport (for abroad)

- Admission letter

- Fee structure

- Academic mark sheets

- IELTS/TOEFL/GRE score

Co-applicant Documents

- Aadhaar & PAN

- Salary slip / ITR

- Bank statement (6–12 months)

- Form 16 (if applicable)

- Business proof for self-employed

How to Apply for an Education Loan Without Collateral

Step 1: Choose the Right Lender

Pick a bank or NBFC based on loan amount needed.

Step 2: Check Your Eligibility

Look at your academic record, co-applicant income, and university list.

Step 3: Submit Application & Documents

Apply online or offline with your KYC and admission letter.

Step 4: Verification

The lender verifies your documents, financial background, and university rank.

Step 5: Loan Approval

Unsecured loan approval usually takes 5–14 days.

Step 6: Disbursement

Loan disbursed to university or student according to requirement.

Tips to Improve Your Chances of Getting an Unsecured Education Loan

✔ Maintain a strong academic record

✔ Apply with a co-applicant who has stable income

✔ Choose universities with good global ranking

✔ Keep your documents clear and complete

✔ Apply early—minimum 3 months before joining

✔ Check NBFC schemes for higher amounts

These steps significantly increase approval.

FAQs

1. Can I get an education loan without collateral in India?

Yes, both banks and NBFCs offer collateral-free education loans. Banks typically give up to ₹7.5 lakh, while NBFCs offer ₹40–75 lakh for study abroad. Approval depends on academics, university ranking, and co-applicant income. Good profiles get faster processing.

2. What is the interest rate for unsecured education loans?

Government banks charge around 10%–12.5%, while NBFCs charge 11%–15% depending on the student’s profile. The final rate depends on course, country, and repayment capacity. Top university admits get the lowest interest.

3. Do I need a co-applicant for unsecured education loans?

Yes, almost all lenders require a co-applicant such as a parent or guardian. Their income determines loan eligibility. Only Prodigy Finance and Leap Finance provide loans without co-applicant for selected universities.

4. How much loan can I get without collateral?

Government banks offer up to ₹7.5 lakh, while NBFCs can provide ₹50–75 lakh depending on your university and course. Loans for US, UK, Canada, and Australia have higher approval limits. Your academic record also plays a key role.