Instant loan apps have changed the way people borrow money in India. A few years ago, getting a personal loan took days of paperwork and multiple bank visits. Today, you can get money in your bank account in just a few minutes — even if you don’t have a strong CIBIL score. This is why instant loan apps are becoming extremely popular among students, salaried employees, freelancers, and small business owners who need quick cash without long approval delays.

In 2025, several new-age lending platforms have made borrowing easier, faster, and far more accessible. These apps use alternative credit scoring instead of strictly depending on CIBIL, making it possible for people with low or no credit history to get approved. In this complete guide, we will look at the best instant loan apps in India that offer fast approval, flexible repayment, and in many cases, no CIBIL check.

Why Instant Loan Apps Are Popular in India (2025 Trends)

The demand for instant loan apps has increased massively because people prefer speed and convenience. Here’s why these apps are becoming a top choice:

- They require minimal documents

- Fast disbursal within minutes

- No bank visits or paperwork

- No collateral needed

- Suitable for low CIBIL or no credit history

- 100% digital process

- Flexible loan amounts starting from ₹1,000

More people are working in gig jobs, freelancing or running small businesses. These apps support their irregular income model better than banks.

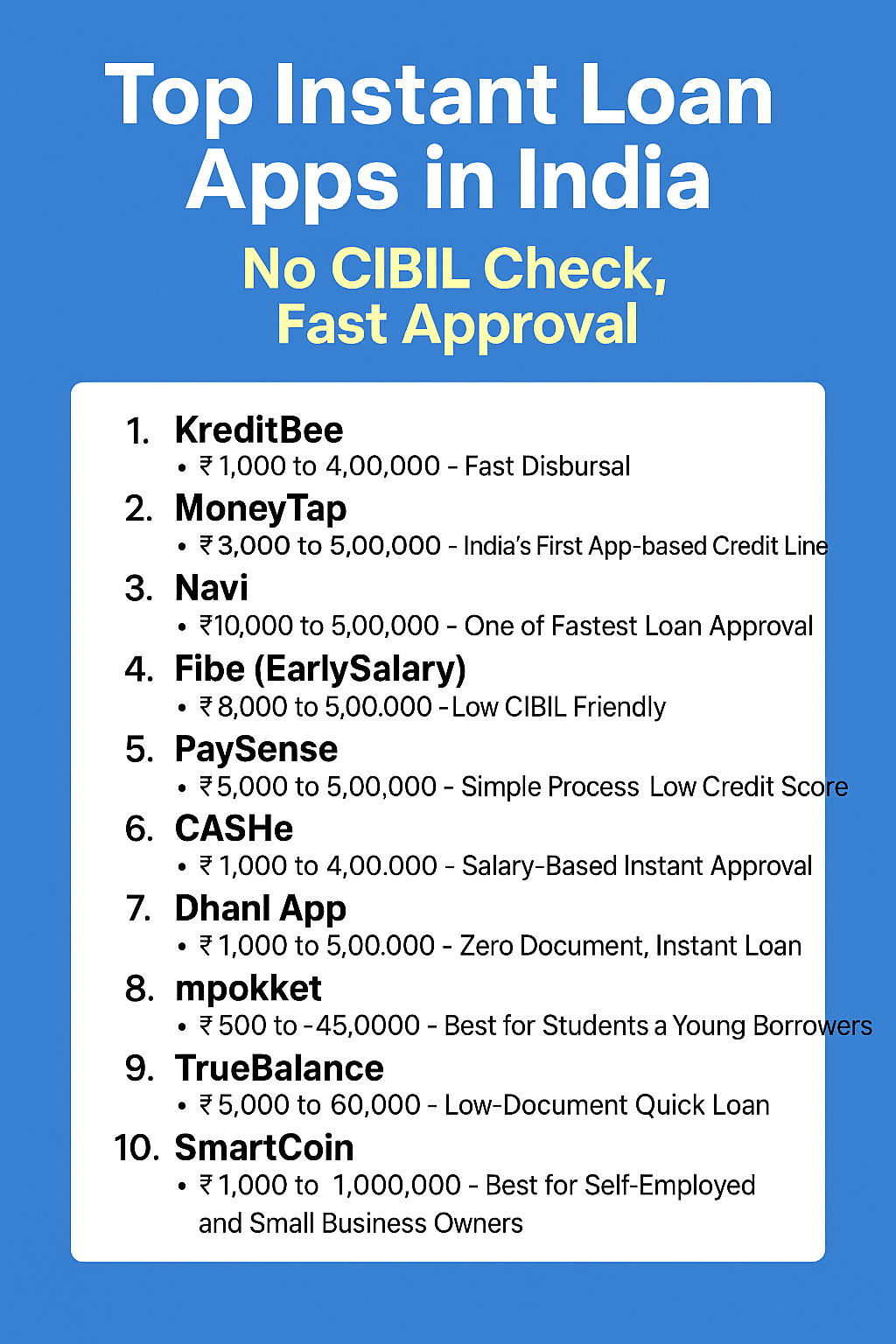

Top Instant Loan Apps in India (No CIBIL Check, Fast Approval)

Below is the list of the most trusted and popular instant loan apps in India in 2025. These apps are well-known for quick approval, transparent terms, and flexible loans.

1. KreditBee – Fast Disbursal & Minimum Documents

KreditBee is one of the most downloaded instant loan apps in India. It offers quick loans to students, salaried employees, and self-employed people. The best part? It doesn’t force you to have a strong CIBIL score. The app uses alternative checks like income statements and transaction history.

Key Highlights:

- Loan amount: ₹1,000 to ₹4,00,000

- Tenure: 3 to 18 months

- Approval time: 10 minutes

- CIBIL required: No strict requirement

It’s an ideal option for new borrowers.

2. MoneyTap – India’s First App-Based Credit Line

MoneyTap offers a personal credit line where you borrow only what you need. Interest is charged only on the amount you use. It’s extremely flexible and suitable for emergency expenses.

Key Highlights:

- Loan amount: ₹3,000 to ₹5,00,000

- Tenure: Up to 36 months

- Approval: Instantly

- CIBIL required: Not mandatory (soft check only)

It works like a credit card without a card.

3. Navi App – One of the Fastest Loan Approvals

Navi is known for its lightning-fast loan approval system. It uses digital verification and AI to process applications in minutes. No heavy documentation is required.

Key Highlights:

- Loan amount: ₹10,000 to ₹5,00,000

- Tenure: 3 to 72 months

- Approval time: Under 5 minutes

- CIBIL required: No strict requirement

Many borrowers prefer Navi for medical and emergency needs.

4. Fibe (EarlySalary) – Low CIBIL Friendly

Fibe is extremely popular among salaried professionals. Even if your CIBIL score is low, you can still get approved based on your salary and bank transactions.

Key Highlights:

- Loan amount: ₹8,000 to ₹5,00,000

- Tenure: Up to 24 months

- CIBIL required: Not strict

- Processing time: 15 minutes

It’s especially good for small and quick personal needs.

5. PaySense – Simple Process, Low Credit Score OK

PaySense accepts borrowers with low credit scores and offers easy EMI plans. It’s beginner-friendly and perfect for people who have never taken a loan before.

Key Highlights:

- Loan amount: ₹5,000 to ₹5,00,000

- Tenure: 3 to 60 months

- Approval: Quick

- CIBIL required: No strict check

Great for emergency loans.

6. CASHe – Salary-Based Instant Approval

CASHe uses a unique social loan quotient (SLQ) score to approve loans. This means your social profile, income, and banking behavior matter more than your CIBIL score.

Key Highlights:

- Loan amount: ₹1,000 to ₹4,00,000

- Tenure: 90 days to 15 months

- CIBIL required: Not needed

- Instant approval

Perfect for salaried professionals needing small, fast loans.

7. Dhani App – Zero Document, Instant Loan

Dhani became popular because of its easy process. Approval requires almost zero paperwork, and the app provides a virtual card for instant use.

Key Highlights:

- Loan amount: ₹1,000 to ₹5,00,000

- Tenure: Flexible

- CIBIL required: Basic check only

Quick and beginner friendly.

8. mpokket – Best for Students & Young Borrowers

mpokket is one of the few apps that offer loans to college students and young professionals. They don’t require a CIBIL score at all.

Key Highlights:

- Loan amount: ₹500 to ₹45,000

- Tenure: 2 to 4 months

- CIBIL required: Not required

A great option for small emergency cash needs.

9. TrueBalance – Low Document Quick Loan

TrueBalance has become popular for offering small-ticket loans with relaxed requirements. You don’t need high credit to get approved.

Key Highlights:

- Loan amount: ₹5,000 to ₹60,000

- Tenure: Up to 6 months

- CIBIL required: Not needed

Ideal for quick personal expenses.

10. SmartCoin – Best for Self-Employed & Small Business Owners

SmartCoin is one of the most trusted loan apps for micro-business owners and self-employed individuals. Their approval is based on income pattern and UPI transactions rather than CIBIL.

Key Highlights:

- Loan amount: ₹1,000 to ₹1,00,000

- Tenure: 2 to 12 months

- CIBIL required: No strict rule

This is excellent for small shop owners, gig workers, and freelancers.

How to Increase Your Chances of Instant Loan Approval

Even if the app doesn’t require CIBIL, following these tips helps:

- Maintain a healthy bank balance

- Avoid EMI bounces

- Keep your salary transactions consistent

- Submit correct documents

- Use the same mobile number linked with Aadhaar

Documents Required for Instant Loan Apps

Most apps ask for only:

- Aadhaar

- PAN card

- Selfie

- Bank statement (PDF 3–6 months)

- Salary slip (for salaried users)

Students need only:

- College ID

- Simple selfie

- Bank account details

Are Instant Loan Apps Safe?

Yes, as long as you use RBI-approved and NBFC-registered apps. Always avoid unverified apps that ask for unnecessary permissions like contacts or gallery.

Stick to trusted apps like KreditBee, MoneyTap, Navi, Fibe, etc.

FAQs

1. Can I get an instant loan without CIBIL in India?

Yes, many apps approve loans without checking CIBIL. They use alternative methods like bank statements, salary slips, and your transaction history. Apps like mpokket, KreditBee, and CASHe are the best options for low CIBIL or no credit score. Approval depends more on your income stability.

2. Are instant loan apps safe and legal?

Yes, but only if they are registered with RBI-approved NBFCs. Always download apps from the official Play Store or App Store. Never use unverified apps that ask for contacts or media permissions. Stick to trusted platforms like Navi, MoneyTap, and Fibe for safe approval.

3. How fast can I get loan money into my bank?

Most instant loan apps transfer money within minutes after verification. Apps like Navi and KreditBee are known for immediate disbursal. If your documents are clear and your bank statements are stable, approval is almost instant. It rarely takes more than a few hours.

4. Can students get instant loans in India?

Yes, platforms like mpokket offer loans to college students without any CIBIL score. Students only need a college ID, selfie, and bank details. Loan amounts are small but useful for emergencies. These loans help build basic credit history for the future.